Auto cameras benefit from CMOS imagers

IC vendors are tailoring their CMOS imagers to meet the requirements of automotive applications.

By Andrew Wilson, Editor

As automakers add more safety and convenience-related functionality to their vehicles, the growing market for automotive camera imaging devices is expected to reach almost 7 million units-or $40 million-by 2008, according to Strategy Analytics (Newton Centre, MA, USA; www.strategyanalytics.com). These cameras will be deployed in camera-aided maneuvering, lane-departure warning, autonomous cruise control, and occupant detection systems. According to the report, Automotive Camera Systems, a number of CMOS imagers are currently available to meet the automotive requirements for temperature and dynamic range.

Established IC vendors such as FillFactory, Melexis, Micron, and ZMD are developing automotive-specific products. In addition, smaller, more-focused companies such as SMaL Camera Technologies and IMS Vision are also targeting this market (see Fig. 1).

Director of Micron Emerging Markets group Curtis Stith specializes in the automotive sector. “The requirements for an automotive imaging device are extreme,” he says. “A sensor needs to function in severe heat or freezing cold, in darkness or direct sunlight, and under rapidly changing conditions. It has to function at high speed and capture, read, and transmit reliable information instantaneously.”

Peter Riendeau, applications and marketing manager at Melexis, agrees. “To meet these demands, our parts are specified to operate between -40°C and +125°C and are qualified under the Stress Test Qualification for Integrated Circuits (AEC Q100) developed by the Automotive Electronic Council (www.aecouncil.com).

“Originally established by Chrysler (www.chrysler.com), Ford (www.ford.com), and GM (www.gm.com) to create common part-qualification and quality-system standards, AEC Q100 qualification allows these devices to gain fast acceptance in mainstream automotive-system applications and reduce design-in cycles,” he says.

Tech specs

Apart from the stringent temperature specifications required by automotive suppliers, the technical specifications demanded of imagers targeted toward this market are also very application-specific. These include operation over a wide range of light intensities and detection of objects that may move quickly in both day and nighttime conditions. Juggling these factors with the need to produce low-cost, highly integrated and programmable devices, most of the vendors currently or soon-to-be supplying imagers to the automotive market have opted for devices fabricated using the CMOS process.

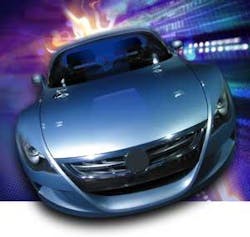

“To properly capture images of moving objects, exposure time and shutter type are critical,” says Don Lake, marketing manager at Micron Technology. “Exposure times need to be as short as necessary to stop motion, yet not arbitrarily so short as to demand excessive sensitivity.” A short exposure time can, for example, result in blur-free black pictures. Blur free, however, does not ensure a distortion-free image. A global shutter-one that exposes every pixel in the photo plane at the same time-is needed for distortion-free imaging of fast-moving objects (see Fig. 2).

Intended specifically for the automotive- applications sector, the Micron MT9V022 features a global shutter and enhanced near-infrared sensitivity. The 1/3-in. monochrome (or color) wide-VGA image sensor features an active-pixel-array format of 750 × 480 pixels designed using 6.0 × 6.0-µm pixels that feature a programmable “piecewise linear” architecture, enabling a dynamic range of 110 dB. This allows images to be captured in both bright sunlight and shadow.

Although the dynamic range of linear CMOS sensors is often less than their CCD counterparts, CMOS vendors developing parts for the automotive market are boosting the dynamic range of their parts with devices that feature logarithmic or logarithmic-like responses (see Vision Systems Design, August 2002, p. 31). In these devices, voltage response is presented as the logarithm of the light intensity. This allows orders of magnitude of illumination levels to be compressed at the output range and produces dynamic ranges often in excess of 120 dB, making the devices useful in relative contrast measurements.

Imagers for others

Last year, FillFactory, now part of Cypress Semiconductor, developed two CMOS image sensors with Melexis specifically for automotive applications: the Melexis MLX75006 CIF format (352 × 288) and MLX75007 Panoramic VGA (750 × 400) devices both feature a snapshot shutter, extended dynamic range by multiple slope operation, and flexible windowing and subsampling. According to Riendeau, Melexis will offer the devices with integrated glass lens options and overmolded plastic packages.

“The programmable pixel response with linear, multiple slopes or logarithmic behavior allows the device to reach the required level of dynamic range for the automotive industry,” says Riendeau. Melexis has been involved with automotive-optical-product development, packaging, testing, and manufacturing since 1999 with the introduction of the MLX90255, a 128 × 1-pixel linear optical array for measuring torque and angle position in steering systems. “The next logical step was the development of 2-D arrays for general automotive imaging,” says Riendeau. These 2-D sensors can be combined and synchronized to create a 3-D vision system. Both devices are available in black-and-white or color versions.

The ZMD Saentis SVGA CMOS imager was also designed in conjunction with a third party, Photonfocus. With a 120-dB dynamic range, the device uses Photonfocus technology to improve the visual in-scene contrast of images containing very bright and dimly lit objects (see Fig. 3). The Saentis chip is available in monochrome with options for RGB Bayer color filters. The camera imager features a global synchronous shutter and a 94-frame/s rate. Integrated with this camera system-on-a-chip is 10-bit ADC output, digital logic to provide clocking to the internal circuitry, a serial interface to control the operation, and internal fixed-pattern noise-cancellation circuitry. According to ZMD, the device will operate in temperatures as high as 125°C.

In October 2004, SMaL Camera Technologies, now part of Cypress Semiconductor, introduced its ACM100 camera designed specifically for automotive-safety and convenience applications. The company also announced that the camera had been selected by an (unnamed) automotive-technology supplier as a component for advanced safety applications, including occupant protection, collision intervention, night vision, and lane-departure warning.

“SMaL’s Autobrite adaptive-dynamic-range technology gives the device a 120-dB dynamic range,” says Maurizio Arienzo, SMaL president and chief executive officer. “In addition, the ACM100 near-infrared sensitivity and low light sensitivity enhance data capture at night and contribute to overall safety system performance,” he says. The ACM100 includes a SMaL VGA 1/3-in. monochrome CMOS imager, ROI exposure control, and strobe synchronization. An evaluation camera kit, the ECK100, is available to qualified Tier 1 suppliers and OEMs.

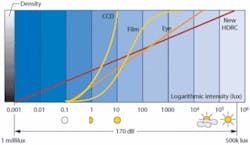

German companies are also partnering with overseas companies to bring CMOS imager technology to the automotive market. Last year, IMS Vision, a company founded in July 2002 through a joint venture between Omron and the Institute for Microelectronics, introduced its HDRC technology that overcomes the limitations of CCD imagers and can produce images with a dynamic range of 170 dB with a sensitivity range of 1 mlux to more than 500,000 lux (see Fig. 4). IMS Vision also offers HDRC camera evaluation kits that demonstrate the capability of the imager.

Dynamic range

While logarithmic-like imagers currently dominate the automotive CMOS imager market, some engineers remain skeptical of the technology. “One of the most important and promising fields of advanced CMOS imager applications is that of automotive engineering,” says Michael Bollerott of the Fraunhofer IMS. “In adaptive cruise control (ACC) systems, for example, these cameras are operated in conjunction with distance radar to extract the highway lane markings so that the system can determine whether a vehicle detected by the radar occupies the same lane as the vehicle carrying the ACC.” ACC cameras must exhibit extremely high ‘optical’ dynamic range to capture all scene details at night and in bright sunlight.

“The human vision system can adapt to an extremely high brightness range,” Bollerott says. “Conventional CCD imagers typically exhibit a dynamic range of about 50-70 dB, while CMOS imagers that use logarithmic readout can achieve up to 140 dB. However, CMOS devices can suffer from loss of contrast and increased noise. In addition, captured logarithmic images can cause problems in subsequent image processing. Such devices also do not allow any local “brightness” adaptation. Because of the limitations of logarithmic readout sensors, Fraunhofer IMS has developed a CMOS imager that combines a dynamic range of 118 dB with linear photoconversion characteristics. According to Bollerott, this ensures better optical image contrast and noise properties than logarithmic-based devices.

Software is key

However, according to Strategy Analytics, it will be image-analysis software that differentiates system functionality. Because of this, the company expects those with software expertise to dominate the market. Early market leaders, it says, include second-tier automotive suppliers such as Valeo (Paris, France; www.valeo.com) and Iteris (Anaheim, CA, USA; www.iteris.com), whose jointly developed AutoVue lane-departure warning (LDW) system was developed for Nissan, and Aisin Seiki (Kariya, Japan; www.aisin.com), which has developed the intelligent parking system used on the hybrid Prius from Toyota (www.toyota.com).

The total market for automotive cameras is expected to grow at a compound average annual growth rate of more than 100% from 2005 to 2010. “Although growth rates look impressive,” says Ian Riches, director of automotive electronics service for automotive camera systems at Strategy Analytics, “it is important to understand that by 2009, the market for image sensors in camera phones will likely be 50 times greater than for vehicles.” However automotive requirements are more stringent than those for consumer electronics, and Strategy Analytics expects automotive-grade image sensors to become a profitable niche.

“Lane-departure warning will be deployed initially in the SUV and minivan market, which includes ‘vulnerable’ vehicles that are prone to rollovers,” says Mark Fitzgerald, senior industry analyst, automotive electronics and telematics practice, at Strategy Analytics. “Rapid adoption of LDW technology in light vehicles would require ease of system integration and, ideally, laws mandating this new safety feature. A bill has been introduced to the US Congress that provides financial incentives to buyers of commercial trucks and passenger vehicles to include safety-oriented technologies such as the LDW system.”

The typical LDW system uses a forward-looking camera mounted behind the windshield to continuously track visible lane markings. This is interfaced to a computer with image-recognition software to analyze vehicle speed, yaw, and steering angles. Infiniti (www.infiniti.com), the luxury division of Nissan (www.nissanmotors.com), is the first auto manufacturer to offer LDW in passenger vehicles for the North American market.

But it may not be the automotive market that is the driving force behind the perfection of CMOS-based imagers. Instead, the drivers may be higher-volume applications that include mobile telephones, personal digital assistants (PDAs), and PCs. “After conquering the mobile phone market, CMOS imagers will be integrated into PDAs and notebook PCs,” predicts Taro Yoshio of Nikkei Electronics Asia (neasia.nikkeibp.com). “Here, the goal is to design equipment to pass images via the Internet, and industry analysts predict that 640 × 480-pixel resolution will be the standard format.

According to a source at Olympus Optical (www.olympus.co.jp), the standard will be between 250,000 and 380,000 pixels. The source says, “If the pixel count drops below a standard TV picture, most people will notice the poor image quality.”

Vision Systems Design’s A to Z of CMOS imager suppliers

| 3DV Systems www.3dvsystems.com | Agilent Technologies www.agilent.com |

| AltaSens www.altasens.com | Amkor Technology www.amkor.com |

| Atmel www.atmel.com | Biomorphic VLSI www.biomorphic.com |

| Canesta www.canesta.com | Cypress Semiconductor www.cypress.com |

| Dalsa www.dalsa.com | Devitech APS www.devitech.dk |

| Dialog Semiconductor www.diasemi.com | Eastman Kodak www.kodak.com |

| ElecVision www.elecvision.com | ESS Technology www.esstech.com |

| Fairchild Imaging www.fairchildimaging.com | FillFactory www.fillfactory.com |

| Foveon www.foveon.com | Fraunhofer IMS www.ims.fraunhofer.de |

| Fujitsu www.fujitsu.com | G-Link Technology www.glinktech.com |

| Hamamatsu Photonics usa.hamamatsu.com | IC Media www.ic-media.com |

| IC-Haus www.ichaus.de | IMS Vision www.hdrc.com |

| Innotech www.innotech.co.jp | Institute of Microsystem Technologies www.imt.fb12.uni-siegen.de |

| Matsushita Electric Industrial industrial.panasonic.com | Melexis www.melexis.com |

| Micron Technology www.micron.com | Mitsubishi Electric www.mitsubishielectric.com |

| Miyota www.miyota.com | Motorola www.motorola.com |

| NeuriCam www.neuricam.com | OmniVision Technologies www.ovt.com |

| Panavision SVI www.panavisionsvi.com | Peripheral Imaging www.p-imaging.com |

| PerkinElmer Optoelectronics optoelectronics. perkinelmer.com | Photonfocus www.photonfocus.com |

| PixArt Imaging www.pixart.com.tw | Pixelplus www.pixelplus.co.kr |

| Pixim www.pixim.com | Rad-icon Imaging www.rad-icon.com |

| Rockwell Scientific www.rockwellscientific.com | Rohm www.rohm.com |

| Samsung Electronics www.samsung.com | Sarnoff Corp www.sarnoff.com |

| Sharp Microelectronics of the Americas www.sharpsma.com | Silicon Vision www.siliconvision.de |

| SMaL Camera Technologies www.smalcamera.com | Sony Corporation www.sony.com |

| ST Microelectronics www.st.com | Symagery Microsystems www.symagery.com |

| TransChip www.transchip.com | ZMD www.zmd.de |