Ute Häussler

In collaboration withVision Systems Design and Inspect magazines, FRAMOS (Taufkirchen, Germany; www.framos.com) has conducted a market survey of trends, interfaces and future developments in camera technology. The study, based on the opinions of 52 users and 8 manufacturers-55% who were from Europe, 23% from North and South America, and 22% from Asia/The Middle East-were presented at the VISION 2016 show in Stuttgart. Europe ranked first in terms of both purchasing and production at 62% and 43%. Manufacturers also produce in Asia (13%) and in America (6%). Behind Europe, Asia and America have equally strong purchasing markets, at 28%. Compared with 2015, American production has declined to 28%, which can be ascribed to weaker survey participation from North and South America.

While camera vendors cited that measurement and logistics comprised 50% and 13% of sales respectively, production automation and quality assurance applications ranked equally at 63%. Medical diagnostics and scientific applications also ranked equally at 38%. Similar results were reflected by camera users who said that 48% of the cameras they purchased are deployed in automation applications, 46% in quality assurance, 40% in measurement, and 29% in scientific applications. Medical diagnostic applications account for 10% of user camera deployments. While traffic applications, including vehicle assistance systems are significant to manufacturers, representing 25% and 13% of sales respectively, they appear to be less relevant to users, with deployment into these application ranking at only 10% and 2% respectively.

As in past years, both camera manufacturers and systems developers see a continued growth in the image processing and machine vision industry with 90% of users intending to introduce or to replace existing systems within the next two years.

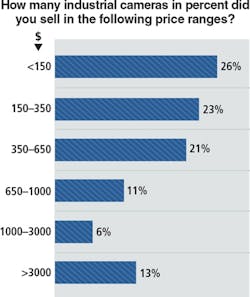

Camera pricing

After a high of 70% in 2014, manufacturers production roadmaps have steadily declined to 44% for production of cameras in the mid-price range between $150 and $650, which reveals some price stabilization after successive drops in the previous years. Low-cost cameras less than $150 are least significant to manufacturers and users in terms of percentage, at 26% and 11%, respectively. Compared with 2015, high-priced cameras from $650/$1,000/$3,000 have dropped by 12% points (Figure 1). As a result, production of customized cameras for specific applications seems to be a strong selling point, and a market advantage, for smaller camera manufacturers.

CMOS vs. CCD

In the light of Sony's discontinuation of CCD imagers, users see the greatest growth for companies such as ON Semiconductor, which currently holds a 29% market share. The declines foreseen by users and manufacturers for Sony in last year's study haven't materialized with 32% of all camera manufacturers currently relying on Sony. In 2 years, Sony is expected to grow back to the 37% levels it had before the discontinuation. Even more users this year rely on Sony compared to last year, with an increase from 35% to 53%.

Camera vendors cite that CMOS technology accounts for 85% of camera sales. Camera users expect to reach this purchasing level in the next two years. With no increase compared to last year, 51% of users rely on CMOS today but are predicting faster growth to 83%, in contrast to 70% in 2015. Based on the shift from CCD technology, e2v benefits with reference to manufacturers (from 3% to 12%) and customer-specific sensors (from 4% to 19%) with an equally positive forecast.

While approximately 30% of users relied on sensors under 1 MPixel last year, in 2016, only 10% do. This significant decline can be marked as growth in the 1-3 MPixel (+10% points), the 3-5 MPixel (+2% points), and the 5-10 MPixel (+3% points) categories. Manufacturers as well as users expect a focus on frame rates between 25 fps and 60 fps today and in the coming two years. At the same time, compared to last year, significant increases in the area of over 100 fps (+13% points for users) and 200 fps (+14% points for manufacturers) have taken place.

Standard interfaces

GigE Vision dominates according to manufacturers, with 33%, followed by Ethernet with 15%. Compared with last year and based on a low proportion of American participants, the previously high Ethernet percentage has been reduced. Manufacturers and users expecting USB 3.0 and GigE Vision to grow fastest with an increase of 8% and 10% points, respectively.

More than 75% of manufacturers and, 60% of users expect bandwidths greater than 5 GB to become relevant or very relevant. 50% of manufacturers believe that USB 3.1 is the most important interface for high-speed applications, followed by 38% for 10 GigE. In contrast, 44% of users favor 10 GigE for fast transmission, and only 37% of users vote for USB 3.1.

Ute Häussler, Manager of Marketing Communications, FRAMOS (Taufkirchen, Germany; www.framos.com)