By Juan Rosales

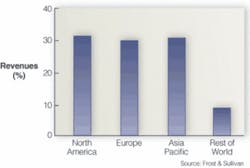

Since its inception and initial implementation as an optimal method for nondestructive testing, machine-vision technology has evolved considerably in terms of sophistication and user-friendliness. A shift toward higher-level image-capturing devices paved the way for vendors to develop optical systems featuring the latest advancements in frame grabber, software, and sensor technology. Furthermore, smart cameras have become widely used by OEMs because of their small size and high processing capacity. With the addition of new machine-vision manufacturers, the market has seen significant advancements in various end-user industries on a global scale (see Fig. 1).

FIGURE 1. Worldwide growth in machine-vision inspection systems continued to be strong in 2007. Three major geographic areas divided the market in rough thirds by market share.

The machine-vision inspection systems market has been experiencing a healthy growth rate in recent years. Because of the overall decline in the prices of systems and components, the number of units shipped has been increasing. Also, throughput and measurement speed of machine-vision systems are continually improving. As a result of these trends, machine-vision equipment has become more accessible to a large number of end users. The perception of machine-vision equipment being too expensive and complicated to use no longer seems to be applicable. However, several challenges still exist within the market that manufacturers must overcome to remain successful.

Despite the overall decreasing costs of vision technology, some manufacturers are hesitant to significantly reduce their prices. This particularly applies to emerging companies that have an immediate need to meet profit margins. Such a situation can be a hurdle if these companies are aiming to make a significant impact within the market. These higher prices, which are sometimes implemented without conducting in-depth market research, may result in difficulty for new entrants to be taken seriously as reputable manufacturers.

Since machine-vision equipment has a long-standing reputation of being a semi-expensive technology, some vendors may not place a high level of importance on their ability to drive down the costs of their products. To be successful in a market with many competitors, however, it is beneficial for the manufacturing engineers of emerging companies to be aware of the various pricing trends associated with their respective types of machine-vision equipment. Accurate market research will allow them to assess the ways in which they will be able to provide value to their end users.

Brand Name Recognition

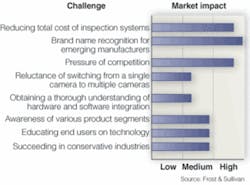

With the presence of numerous machine-vision manufacturers in the market, it may be difficult for emerging companies to make an immediate significant impact (see Fig. 2 on p. 14). This especially holds true if these manufacturers do not have a groundbreaking technological advancement to introduce and are thus not able to directly compete with their larger counterparts. Unless there is a niche product or service that is not offered by many other participants, the advertising efforts of such vendors may be lost in this broad market.

FIGURE 2. In the next five years, manufacturers of machine-vision inspection systems will face a series of challenges.

Most major market participants have become well known by offering different types of affordable vision technology that can be utilized in various applications. Aside from diversifying their product portfolios, these manufacturers also understand how to adapt to changing market conditions while continuing to provide optimal customer service. To garner a positive reputation among end users, emerging machine-vision companies must provide a value proposition similar to those of their competitors.

The abundance of market participants often drives vendors to develop unique and groundbreaking technology. They realize that complacency will lead to a reduction in sales and a less-than-favorable reputation among their competitors and customers. As a result, machine-vision manufacturers must offer a high value proposition to potential customers to gain interest in their vision solutions. By continuing to focus on technology that will benefit the overall market, such vendors will likely remain successful.

In the past, when machine-vision camera equipment was considerably more expensive, it was common for electronics manufacturers, for example, to solve their application problems using just one camera. Although this was a popular method, it proved to be cumbersome at times. While the gradual decrease in camera costs has made it easier for some electronics manufacturers to adopt a multiple-camera approach, others have yet to make this move, as they feel that such a change does not add additional benefits to their operations.

Despite resistance from some end users, it is important to understand the significance of using multiple camera angles for high-performance inspection. Machine-vision systems with the ability to interface with numerous cameras are readily available within the market. Designed for high-speed applications that require the inspection of upwards of sixty parts per second, such systems are simultaneously able to process multiple image views. The ability to analyze the front, back, and top surfaces of various specimens is likely to result in a higher overall rate of flaw detection.

The demand for cameras to integrate with PC systems will continue to increase. However, hardware manufacturers who do not have experience in developing software are likely to face difficulty in doing so. Conversely, software manufacturers who focus on the creation of algorithms are likely to face fewer difficulties when integrating their products with vision hardware.

To remain competitive in this market, machine-vision manufacturers must possess a sufficient degree of expertise when performing complete system integration. In the past, machine-vision software could not be easily integrated, and this resulted in increased software development time and costs. However, vendors are now utilizing object linking and embedding methods that reduce the integration time in the development of machine-vision systems. As a result, the efficient integration of hardware and software applications is possible.

Niche companies, such as optics and lighting manufacturers, often focus on the development of one or two specific types of machine-vision components. During this process, they may not necessarily be committed to researching the various other developments occurring within the market. As a result, there is a possibility that they may manufacture parts that are incompatible with other types of vision technology.

Manufacturers must stay up to date on the standards of new technology for various types of products, particularly cameras. Optics manufacturers, for instance, must comply with the higher standards of emerging camera equipment. If a powerful camera has been developed to exhibit high-level and sophisticated capabilities, but is provided with an outdated or inadequate lens by the optics supplier, then the camera cannot be utilized to its fullest potential.

Educating End users

Machine-vision manufacturers should have a clear understanding of their customers’ knowledge of utilizing various technologies. This especially holds true at present, when innovative advancements are constantly breaking new ground in the market. End users should not only be adept in terms of how to implement such equipment, but they should also be well versed in materializing new applications.

To maintain a strong relationship with their customers and to ensure that they are successful in their machine-vision applications, it is vital that manufacturers assess the utilization of their equipment and provide formal training, if necessary. This will alleviate confusion on the part of the customer and create a more user-friendly process for inspection.

In conservative industries, OEMs are not likely to implement new technologies into their inspection processes. As a result, emerging manufacturers can expect challenges for success in these areas. Often, such OEMs want to ensure that a machine-vision manufacturer has a long-standing tradition of success before developing any collaborative relationship. Once a developer’s track record has been established, the comfort level between the OEM and the vendor will increase, and the likelihood of collaborating with a newer, emerging vendor will decrease significantly.

There is an increased need for machine-vision manufacturers, particular for those new to the market, to promote the advantages of their technologies to such conservative industries. Unless the emerging company can immediately contribute a groundbreaking solution to the machine-vision market, it will be difficult to initially make an impact.

The machine-vision inspection-systems market is poised for continued growth over the next few years. For manufacturers to fully maximize their revenue potential, they must understand the challenges that may confront them. From competition pressures to the integration of system components, it is vital for industry participants to remain abreast of the consequences that may occur if they are not prepared for such obstacles. Those who can leverage their knowledge of industry trends and challenges will be able to successfully adapt to changing market conditions and, as a result, thrive in a competitive and dynamic landscape.

JUAN ROSALES is a research analyst at Frost & Sullivan; www.frostandsullivan.com.