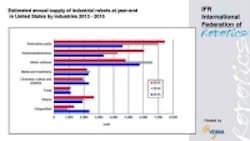

In 2015, the United States had 27,500 units of newly-installed industrial robots, which is more than three times the amount installed during the financial crisis of 2009.

In total, the United States has seen approximately 135,000 new robots installed since 2010, which the International Federation of Robotics (IFR) says is due to the need for automation in the automotive industry. Other factors include the ongoing trend to automate production in other segments to strengthen the competitiveness of American industry globally, to keep manufacturing at home, and sometimes, to bring back manufacturing that had previously been outsourced to other countries, according to the IFR.

Largely responsible for this growth is the US automotive industry, which saw more than 60,000 industrial robots installed in the US between 2010 and 2015. Only in China were there more industrial robots installed during the same time period at almost 90,000 units. Overall, the robot density in the United States has increased to 1,218 robots per 10,000 employees in the automotive industry in 2015 (Japan = 1,276; Korea = 1,218; Germany=1,147; France=940 robots per 10,000 employees).

While the need for automation in the automotive sector has seen continual growth, a moderate decrease in the overall sales growth is anticipated for 2016 – 2017. However, suggested the IFR, the retooling necessary for new car models will then drive an increase in demand for industrial robots starting in 2018 – 2019.

The fastest-growing industry for industrial robots in the United States (2014 – 2015 = +41%) has been the electronics industry. Furthermore, increasing numbers of orders can also be expected from the metals and machinery industry, the rubber and plastics industry, the pharmaceutical and cosmetics industry, and the food and beverage industry, said the IFR.

"The rapid rise of robot use in the United States is impressive for several reasons," said Jeff Burnstein, President of Robotic Industries Association. "First, we’ve seen the industry’s largest user, the automotive industry, accelerate its purchases of robots and at the same time create more jobs in the manufacturing process. Second, we’ve seen strong growth in the use of robots in general industry, as robots further penetrate industries such as life sciences, warehousing, and semiconductor and electronics manufacturing."

"Finally," he added, "the use of robots is rising in small and medium sized companies who see robotics as a key factor in improving productivity and product quality in order to stay globally competitive. We expect these trends to continue well into the future."

This year, order and shipments of robots in not just the US, but in North America, have set new records for the first nine months of the year, with a total of 23,985 robots valued at $1.3 billion having been ordered from North American companies in the time period, according to the Robotic Industries Association (RIA).

This figure represents a 7% increase in units and 3% in dollars over the same period in 2016, which held the previous record. Robot shipments to North American customers through September totaled 22,050 robots valued at $1.3 billion, breaking the previous record set in 2015 by 3% in units and 11% in dollars.

Growth was reportedly driven by increasing demand from automotive OEMs and component suppliers, with robot orders from these two sectors up 14% through September. Robots ordered into the food and consumer goods industry increased by 40% year over year. Approximately 269,000 robots are now in use in North American factories, third only to Japan and China, according to the RIA.

View the IFR report.

Share your vision-related news by contacting James Carroll, Senior Web Editor, Vision Systems Design

To receive news like this in your inbox, click here.

Join our LinkedIn group | Like us on Facebook | Follow us on Twitter

Learn more: search the Vision Systems Design Buyer's Guide for companies, new products, press releases, and videos

About the Author

James Carroll

Former VSD Editor James Carroll joined the team 2013. Carroll covered machine vision and imaging from numerous angles, including application stories, industry news, market updates, and new products. In addition to writing and editing articles, Carroll managed the Innovators Awards program and webcasts.