This should come as no surprise: Sales in the machine vision market declined in 2023, compared to 2022, according to several recent reports. However, analysts and industry insiders expect a better year in 2024.

For example, Interact Analysis (Irthlingborough, UK), a research firm specializing in automation, says total global revenue for machine vision vendors declined to $6.3 billion in 2023, down from $6.5 billion in 2022.

The Association for Advancing Automation (A3) also reports declines in revenues, although its findings are confined to North America. Specifically, A3 (Ann Arbor, MI, USA) says machine vision sales declined 7%, from $3.116 billion in 2022 to $2.895 billion in 2023. Among components, cameras saw the largest sales decrease (-11.3%) in 2023, compared with 2022, followed by optics (-7.5%), imaging boards (-6.7%) and lighting (-0.1%). On the other hand, software sales increased 4.4%.

Manufacturers of turnkey machine vision systems saw sales in North America decline 3.7%, while sales of smart cameras plummeted 17.8% in 2023, compared with 2022.

Orders for robotics declined 30% in North America from 44,196 units in 2022 to 31,163 in 2023. However, orders increased in the 4th quarter of 2023, compared with the 3rd quarter.

The industries adopting robotics and automation solutions include electric vehicles, food, retail, warehousing, agriculture, and construction.

Better Year Ahead

After a lackluster 2023, however, both organizations expect sales to improve in 2024.

Interact Analysis predicts a global growth rate in 2024 of 1.4% in the machine vision market, with higher annual growth rates returning in 2025. “While price pressures will persist for machine vision vendors in the first half of 2024, order books are expected to start refilling in the second half of the year,” the firm writes in a January 2024 press release.

Related: Machine Vision and Imaging Trends in Automation: A View from the Trenches in 2024

For its part, A3 fields regular surveys of its members to ask about their expectations for sales during the upcoming six months and the full year.

When asked about their sales expectations for the entire automation industry, including machine vision, for 2024, a majority predicted a better year over the next 12 months in North America. A total of 39.30% of respondents expect sales to be up significantly (10% or more) in 2024, compared with 2023, and 39.74% expect sales to be up moderately (1% to 10%).

Only 13.54% of its members predict flat sales in 2024, while 6.11% expect a moderate decline (-1% to -10%) and 1.31% expect sales to be down significantly (-10% or more).

An overwhelming majority of A3’s survey respondents expect to either hire more employees in 2024 (54.59%) or keep their employee headcount the same (45.67%). Only 1.75% of them expect to reduce headcount.

Respondents did not underestimate the challenges facing the automation industry. When asked to choose the most significant issue, nearly half (44.98%) said economic challenges, while 23.14% said lack of a skilled workforce, 10.92% noted the high initial investment, 9.17% said technological complexity, 6.55% said market acceptance, and 2.62% said regulatory challenges.

When asked “which emerging technologies are you considering for implementation in your automation solutions in 2024,” AI came out on top, with 50.23% choosing AI-enabled vision technologies and 30.23% choosing AI-enabled programming. The other technologies they chose include additive manufacturing, or 3D printing, (25.58%), cloud computing (20.93%), edge computing (20.47%), large language models in AI (17.21%), 5G connectivity (14.88%), augmented reality (13.49%), other (13.49%) and blockchain (1.86%).

Longer Term Strength

Interact Analysis expects the machine vision market to grow over the longer term, too. The firm predicts a growth rate of 6.4% with revenues increasing from $6.5 billion in 2022 to $9.3 billion in 2028.

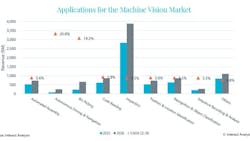

Inspection is the largest application segment in the machine vision market (40% of use cases in 2022), and the firm expects revenues for this segment to grow 5.5% to $3.9 billion in 2028. The autonomous segment, including mobile robots, will experience the strongest growth (20.8%) between 2022 and 2028, followed by bin picking (19.2%).

“New vendors continue to enter the market, with over 200 active worldwide. We are seeing increasing activity from new vendors in China in particular, as well as in those territories where machine vision products are increasingly being used for autonomous driving and bin-picking,” says Jonathan Sparkes, research analyst at Interact Analysis.

About the Author

Linda Wilson

Editor in Chief

Linda Wilson joined the team at Vision Systems Design in 2022. She has more than 25 years of experience in B2B publishing and has written for numerous publications, including Modern Healthcare, InformationWeek, Computerworld, Health Data Management, and many others. Before joining VSD, she was the senior editor at Medical Laboratory Observer, a sister publication to VSD.